Both the Labour manifesto and the Tories’ pledges will barely increase gross domestic product (GDP) and hardly impact anything else in the economy, either. That’s according to analysis by the think thank the National Institute for Economic and Social Research (NIESR).

Labour manifesto: increasing GDP by basically nothing

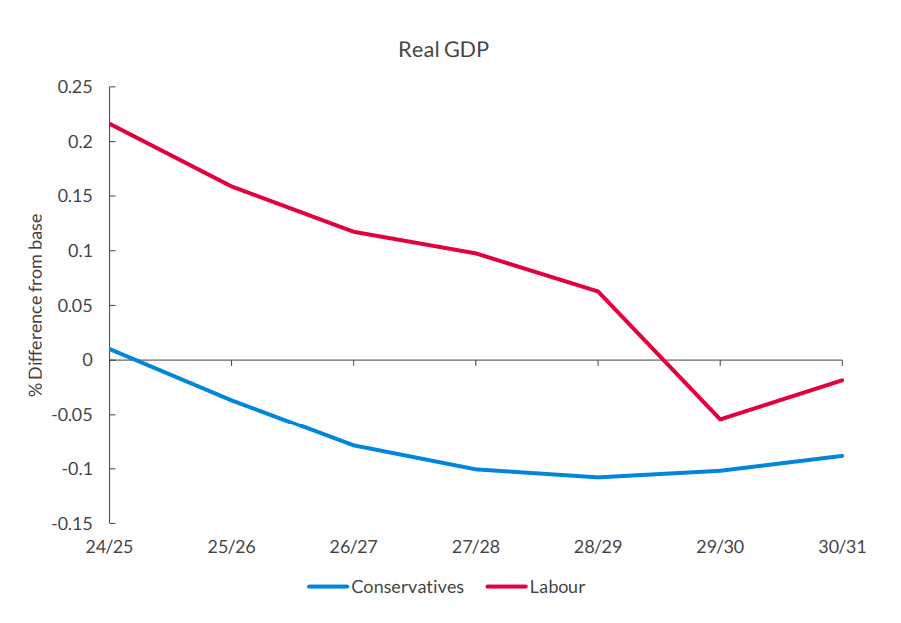

Although neither party would meet current fiscal targets, the Labour Party’s tax and spending plans would slightly increase real GDP over the next five years, whilst the Conservative Party’s plan would slightly improve the public finances, according to NIESR’s macroeconomic analysis of the main parties’ spending pledges.

Using NIESR’s in-house global econometric model, NiGEM, the analysis assesses the figures from the Conservative Costings Document and Labour’s Fiscal Plan, finding that:

- Labour manifesto tax and spending plans increase real GDP by an average of 0.1% over the next five years, driven primarily through investment via their Green Prosperity Plan.

- The Conservatives’ tax and spending plans’ decrease real GDP by an average of 0.1%.

Although neither party would meet current fiscal targets, the Conservative plan slightly improves the public finances relative to NIESR’s baseline forecast.

The Labour manifesto initial investment in the Green Prosperity Plan slightly increases the debt-to-GDP ratio.

Both parties’ plans would have a positive impact on business investment:

- Labour’s plans would boost it by 0.6% on average driven by productivity gains and increased economic activity.

- The Conservatives’ plans would boost it by 0.5% on average, driven by lower long real rates.

Neither the Conservatives nor Labour will have the Debt-to-GDP ratio falling until 2030/31.

To meet the current target – that is to have the debt-to-GDP ratio falling at the end of the five-year period – the Conservatives would need it to fall by one percentage point in 2028/29, about £32bn, while Labour would need it to fall by two percentage points, about £65bn, and not rise further.

‘Tinkering around the edges’

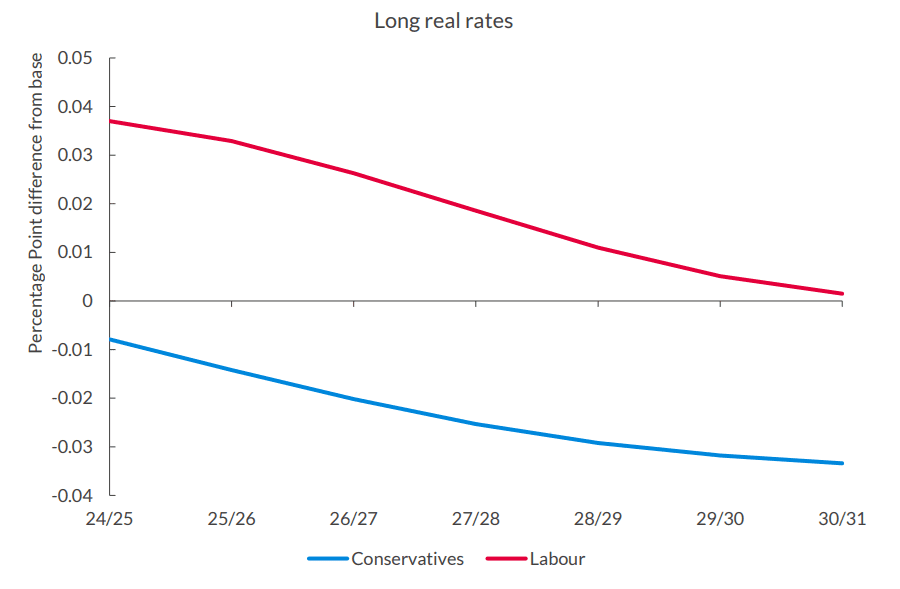

Moreover, both parties’ plans would barely impact on overall interest rates. The extra investment from the Labour manifesto leads to a higher policy rate, as extra demand in the economy means the central bank needs to keep rates higher for longer to tame inflation. Long real rates (interests rates adjusted for the effects of inflation) increase by about 3.7 basis points.

In contrast, as demand and the debt burden fall under the Conservative plans, inflationary pressures ease. This leads to a lowering of the long real rate by about 3.5 basis points in the long run. It’s important to note that this effect is so small as to be effectively zero:

Professor Stephen Millard, deputy director for macroeconomics at the NIESR, said:

This analysis suggests that both parties plans are simply ‘tinkering at the edges’. What is needed is bolder thinking: a plan to increase spending where it is desperately needed, to acknowledge the need to raise taxes to finance this, and to rethink the current fiscal framework so as to allow more borrowing where it will lead to higher growth in the future.

Featured image via X – screengrab