While everyone is shouting about the fact that inflation has fallen to 2%, a think tank is already warning that we’re not out of the woods, yet – and that inflation is likely to go UP again later in the year.

Inflation: down, but not for long?

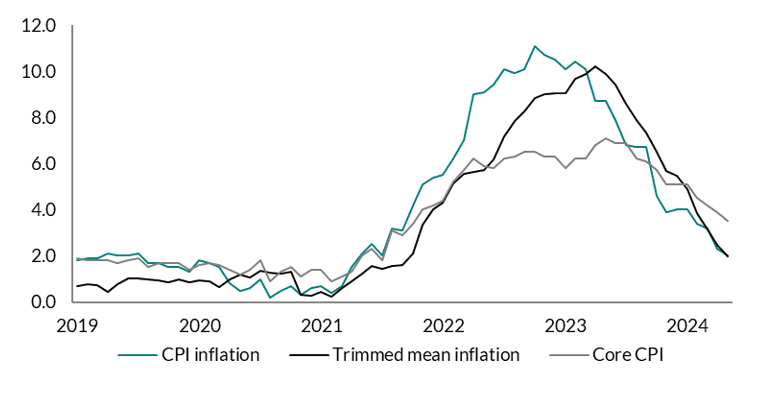

Today’s Office for National Statistic (ONS) figures indicate that annual CPI inflation was 2% in May, falling from 2.3% in April. This figure reflects upward contributions, such as those from transport, being offset by downward contributions from the majority of other item categories, particularly food and alcoholic beverages:

The fall in the annual CPI rate to the Bank of England target in May is positive news. However, think tank the National Institute of Economic and Social Research (NIESR) says inflation will most likely rise again in the second half of this year due to base effects.

It notes that it is important to keep an eye on month-on-month figures (‘new’ inflation) to determine to what extent we will see it rebound in the second half of 2024.

In fact, the NIESR says the fall in May was consistent with its projection last month, due to higher than projected month-on-month inflation.

So, even though headline CPI reached 2%, we’re not out of the woods yet.

Not out of the woods, yet

Though indicators of underlying inflationary pressures all fell on the month, some remain high. ONS data shows that core inflation remained elevated at 3.5%, as did services at 5.7%. Given last week’s elevated wage growth data, services may remain elevated in the near-term, posing an upwards risk to headline inflation.

However, it is encouraging that NIESR’s trimmed-mean inflation measure (which excludes 5% of the highest and lowest price changes to eliminate volatility) fell to 2%, reaching this rate for the first time in nearly three years.

This indicates that the fall in headline inflation is not driven by extreme price changes (e.g. energy price drops) but rather, reflects the average weighted price change in the basket – which is a good development.

Altogether, the NIESR expects the Bank of England to exercise caution at its meeting on Thursday 20 June and hold interest rates, due to the presence of upside risks from still-strong services inflation.

Paula Bejarano Carbo, NIESR economist, said:

Annual CPI inflation has fallen to the Bank of England’s 2% target for the first time since July 2021. While this is positive news, we expect to see inflation rebound somewhat from June onwards. Given that today’s data indicate that core inflation remains elevated, this rebound might be sharper than projected.

As a result, we expect the MPC to exert caution at its upcoming meeting and hold interest rates, despite today’s encouraging fall in the headline rate.

For a breakdown of what inflation is and how it is calculated, read NIESR’s blog post here.

Featured image via