For those who do not dwell on the cruel and barbarous actions of the Stasi, what is now often forgotten is that the GDR also represented an effort to build a completely new and egalitarian society. Gender equality and equal pay for men and women were part of the GDR from the very beginning. The…

Wise Words I

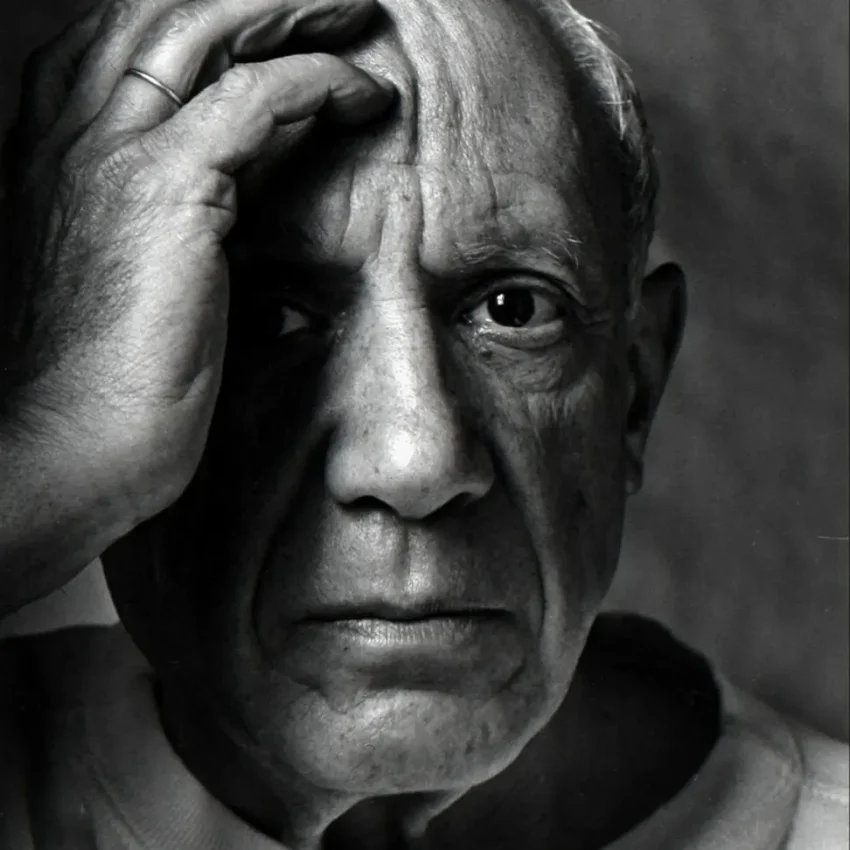

The older you get the stronger the wind gets—and it’s always in your face. —Pablo Picasso

Gatwick Blairport

The transport secretary Heidi Alexander tells the annual dinner of trade body, Airlines UK in London.” I love flying – I always have”. Meanwhile Kier Stammer (sic) bubbles with pride at the UK’s progress on carbon emissions ………. oh well, thats politics. Or as the transport secretary and Margaret Thatcher would call it, “growth”.